Answer the questions based on the following information.

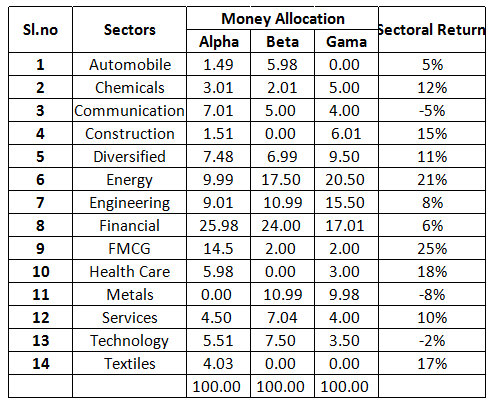

The table below gives the details of money allocation by three Mutual funds namely, Alpha, Beta, and Gama. The return for each fund depends on the money they allocate to different sectors and the returns generated by the sectors. The last column of the table gives return for each of the sectors for a one year period.

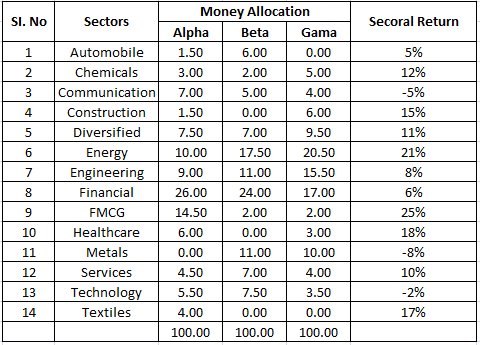

As the numbers are far apart we can approximate the money allocation data to the nearest multiple of 0.5. The money allocation data can be approximated as below.

Let us assume that Rs. 100 is invested in each fund.

Total return on investing Rs. 100 in fund Alpha =

1.5*1.05+3*1.12+7*.95+1.5*1.15+7.5*1.11+10*1.21

+9*1.08+26*1.06+14.5*1.25+6*1.18+4.5*1.10+5.5*.98+4*1.17 = Rs. 111.24.

Hence, net return per rupee in fund Alpha = $$\dfrac{111.24}{100}$$ = Rs. 1.1124.

Similarly, we can calculate total return on investing Rs. 100 in fund Beta and Gama.

Net return per rupee in fund Beta = $$\dfrac{107.225}{100}$$ = Rs. 1.07225.

Net return per rupee in fund Gama = $$\dfrac{109.48}{100}$$ = Rs. 1.0948.

We can see that return per rupee is the highest for Alpha fund. Hence, option A is the correct answer.

Create a FREE account and get:

- All Quant Formulas and shortcuts PDF

- 170+ previous papers with solutions PDF

- Top 5000+ MBA exam Solved Questions for Free